You’re about to embark on a journey of unraveling the mysterious world of taxes. Whether you’re a tax-filing novice or a seasoned taxpayer, “Understanding Taxes: A Comprehensive Guide” serves as your ultimate go-to resource. Packed with valuable insights and simplified explanations, this guide is designed to demystify the complexities of the tax system and empower you to make informed financial decisions. Say goodbye to confusion and hello to clarity as you navigate the intricacies of taxes with ease. Taxes are an essential part of every individual’s life. Whether you are a working professional, a business owner, or self-employed, understanding taxes is crucial to ensure compliance with the law and avoid any penalties. In this comprehensive guide, we will walk you through the various aspects of taxes and provide you with the knowledge you need to navigate the tax landscape with ease.

Filing Taxes

Who Needs to File Taxes?

Filing taxes is a requirement for most individuals who have earned income during the tax year. If you are a U.S. citizen or resident alien, you generally need to file a federal tax return if your income exceeds a certain threshold. The income thresholds vary depending on your filing status (single, married filing jointly, head of household, etc.) and your age. It is important to note that even if you do not meet the income threshold, you may still need to file a tax return if you meet certain other criteria, such as self-employment income or qualifying for a refundable tax credit.

Types of Income

Income can come in various forms, and it is essential to understand the different types of income when filing taxes. The most common types of income include wages, salaries, tips, self-employment income, investment income, rental income, and unemployment compensation. Each type of income may be subject to different tax rules and reporting requirements. Moreover, it is crucial to report all sources of income accurately to avoid any potential audit or penalty.

Deadline for Filing Taxes

The deadline for filing your federal tax return is typically April 15th of each year. However, if April 15th falls on a weekend or holiday, the deadline may be extended. It is important to mark this date on your calendar and ensure you submit your tax return on time. Failing to meet the deadline may result in penalties and interest charges. If you need more time to file your taxes, you can request an extension, which will give you an additional six months to file your return. However, it’s important to note that an extension to file does not grant an extension to pay any taxes owed.

Common Tax Deductions

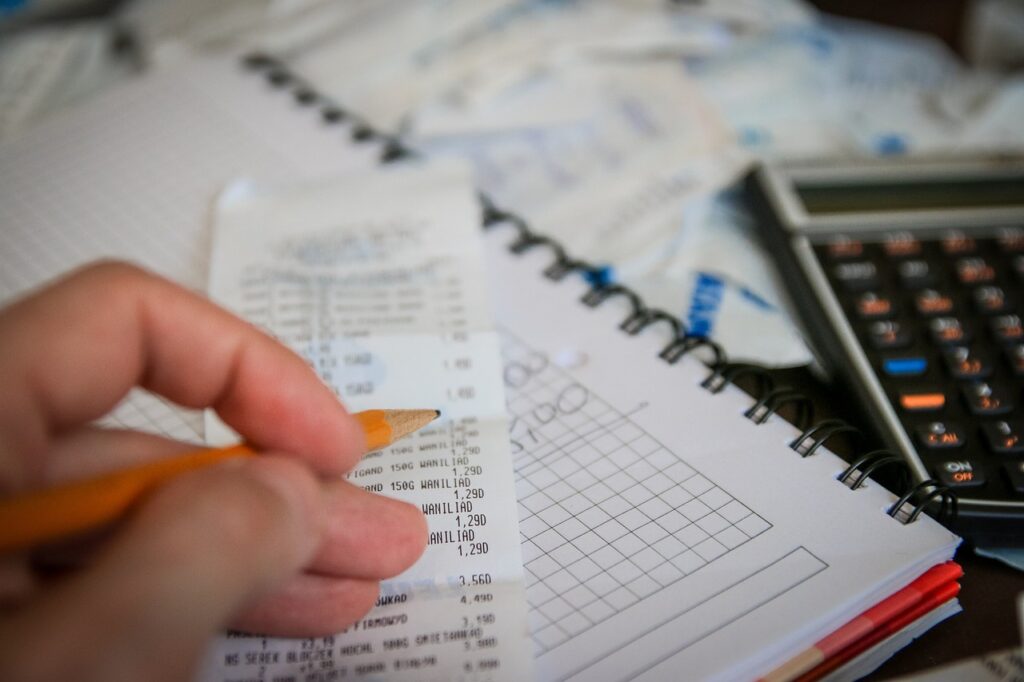

Tax deductions are a great way to lower your taxable income and potentially reduce your tax liability. While tax deductions may vary depending on your personal situation, there are some common deductions that many taxpayers can take advantage of. These include deductions for mortgage interest, state and local taxes, charitable contributions, educational expenses, and medical expenses that exceed a certain percentage of your income. It is crucial to keep proper documentation to substantiate your deductions, such as receipts and records of expenses.

Understanding Tax Forms

Types of Tax Forms

Tax forms are the foundation of the tax-filing process. The Internal Revenue Service (IRS) provides various tax forms, each serving its purpose depending on an individual’s or business’s circumstances. The most commonly used tax forms include Form 1040 (Individual Income Tax Return), Form 1099 (Miscellaneous Income), and Form W-2 (Wage and Tax Statement). Business entities, such as corporations, partnerships, and self-employed individuals, may need to file additional forms, such as Form 1120 (Corporate Income Tax Return) or Schedule C (Profit or Loss from Business).

Key Information on Tax Forms

Tax forms contain essential information that must be accurately reported to the IRS. This includes personal information such as your name, social security number, and filing status. Additionally, tax forms require detailed information about your income, deductions, and credits. It is crucial to double-check all the information you provide on tax forms to ensure accuracy and minimize the risk of errors or discrepancies.

Commonly Used Tax Forms

While there are numerous tax forms available, some forms are commonly used by individuals and businesses. For individual taxpayers, Form 1040 is the standard tax form used to report income and claim deductions and credits. Additionally, taxpayers who receive income from interest, dividends, or self-employment may need to file additional forms, such as Schedule B or Schedule SE. Businesses may use forms such as Form 1120 for corporations, Form 1065 for partnerships, or Schedule C for self-employed individuals.

This image is property of pixabay.com.

Taxable Income

What is Taxable Income?

Taxable income is the portion of your income that is subject to federal income tax. It is calculated by subtracting certain deductions and exemptions from your total income. Taxable income serves as the basis for calculating your tax liability and is different from your gross income, which is the total amount you earn before any deductions. Understanding what income is taxable and what is not is crucial to ensure accurate reporting and calculation of your tax liability.

Types of Taxable Income

Taxable income encompasses various types of income, including wages, salaries, tips, self-employment income, rental income, interest, dividends, capital gains, pensions, and annuities. It is important to note that not all types of income are taxable. Some forms of income, such as certain social security benefits and life insurance proceeds, may be excluded from taxable income. However, it is crucial to understand the specific rules and qualifications for each type of exclusion to ensure compliance with tax laws.

Exclusions from Taxable Income

Certain types of income are excluded from taxable income. The most common exclusions include specific types of Social Security benefits, gifts, and inheritances. Additionally, some income from qualified scholarships or fellowships may be excluded. It is important to familiarize yourself with the specific criteria for each exclusion to determine if you qualify and properly report your income to the IRS.

Tax Rates and Brackets

Understanding Marginal Tax Rates

The U.S. federal tax system operates on a progressive tax rate structure, which means that individuals with higher incomes pay a higher tax rate on their earnings. This system is commonly referred to as marginal tax rates. Marginal tax rates work by dividing taxable income into different income brackets, each taxed at a specific rate. As your income increases, you move up the tax brackets and pay a higher tax rate on the additional income. Understanding how marginal tax rates work is essential for accurate tax planning and estimating your tax liability.

Income Tax Brackets

The income tax brackets determine the applicable tax rates for different levels of taxable income. The U.S. federal income tax system currently has seven tax brackets, ranging from 10% to 37%. The exact income ranges for each tax bracket may change annually based on inflation adjustments. It is important to review the current tax brackets each year to ensure accurate tax planning and calculation of your tax liability.

Calculating Tax Liability

Calculating your tax liability involves determining which tax bracket your taxable income falls into and applying the corresponding tax rate to the income in that bracket. It’s important to note that only the income within each bracket is taxed at that specific rate, not your entire income. This is what makes the U.S. federal tax system progressive. By multiplying the taxable income within each bracket by the applicable tax rate and summing up the results, you can calculate your total tax liability. However, to determine the final amount owed or refunded, you must also consider deductions, credits, and withholdings.

This image is property of pixabay.com.

Tax Credits

Types of Tax Credits

Tax credits are a valuable tool for reducing your tax liability dollar-for-dollar. There are various types of tax credits available, each with its own eligibility criteria and requirements. Some common types of tax credits include the Child Tax Credit, Earned Income Tax Credit, American Opportunity Credit, and Lifetime Learning Credit. Tax credits can significantly lower your tax bill or even result in a refund, making them an essential part of tax planning and maximizing your tax savings.

Common Tax Credits

The Child Tax Credit is one of the most commonly claimed tax credits. It provides a credit of up to $2,000 per qualifying child and may be refundable for certain taxpayers. The Earned Income Tax Credit is another popular credit designed to help low- to moderate-income individuals and families. This credit can be substantial and may vary depending on factors such as income, filing status, and the number of qualifying children. Other common tax credits include education credits, such as the American Opportunity Credit and Lifetime Learning Credit, which provide tax relief for qualified education expenses.

How to Claim Tax Credits

To claim tax credits, you must meet the specific eligibility requirements for each credit. This may include having a certain level of income, meeting age or education criteria, or having qualifying dependents. To claim the credits, you must accurately complete the required tax forms, such as Form 1040 or the applicable schedule or form associated with the credit. It is essential to review the instructions and guidelines provided by the IRS for each specific credit to ensure proper documentation and compliance.

Tax Deductions vs. Tax Credits

Understanding the Difference

While both tax deductions and tax credits can reduce your overall tax liability, they work differently. Tax deductions reduce your taxable income by subtracting specific expenses or amounts from your gross income. These deductions are typically based on qualified expenses, such as mortgage interest, state and local taxes paid, medical expenses, and business-related expenses. On the other hand, tax credits directly reduce your tax liability by subtracting a specific dollar amount from the total amount of tax owed.

Claiming Deductions and Credits

To claim deductions, you must itemize your deductions on Schedule A if your total itemized deductions exceed the standard deduction amount. This allows you to deduct eligible expenses and reduce your taxable income. However, if your total itemized deductions do not exceed the standard deduction, it may be more advantageous to claim the standard deduction instead. Claiming tax credits involves completing the necessary corresponding forms or schedules and accurately calculating the credit amount based on your eligibility and documentation.

This image is property of pixabay.com.

Tax Planning

Why Tax Planning is Important

Tax planning is the process of strategically organizing your finances and transactions to minimize your tax liability legally. By understanding various tax-saving strategies and taking advantage of deductions, credits, and exemptions, you can effectively reduce your overall tax burden. Moreover, tax planning allows you to anticipate and prepare for your tax obligations, ensuring you have the necessary funds readily available at tax time.

Strategies for Minimizing Tax Liability

There are several strategies you can employ to minimize your tax liability. These include maximizing your contributions to retirement accounts, such as 401(k) plans or Individual Retirement Accounts (IRAs), taking advantage of tax-advantaged investment accounts, like Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs), and exploring tax-efficient investments. Additionally, timing your income and expenses strategically, such as deferring income or accelerating deductible expenses, can also help lower your tax liability.

When to Consult a Tax Professional

While it is possible to navigate the tax landscape on your own, there are instances where it is beneficial to consult a tax professional. This is especially true if you have complex financial situations, own a business, or face a tax audit. A tax professional can provide valuable guidance, ensure accurate tax compliance, and help you optimize your tax planning strategies. With their expertise and knowledge of tax laws and regulations, they can help minimize errors, alleviate potential tax-related stress, and identify opportunities for additional tax savings.

Self-Employment Taxes

What are Self-Employment Taxes?

Self-employment taxes are taxes paid by individuals who work for themselves or operate their own business. When you are self-employed, you are responsible for paying both the employer and employee portions of Social Security and Medicare taxes. Unlike employees who have their taxes withheld from their paychecks, self-employed individuals need to calculate and pay their self-employment taxes independently.

Calculating Self-Employment Taxes

To calculate self-employment taxes, you must determine your net self-employment income, which is your total self-employment income minus eligible business expenses. The self-employment tax rate is generally 15.3%, which consists of the Social Security tax rate of 12.4% and the Medicare tax rate of 2.9%. However, it’s important to note that the Social Security portion is only applied to a certain income threshold.

Reporting Self-Employment Taxes

Self-employment taxes are reported on Schedule SE, which is attached to your Form 1040. In addition to reporting your self-employment tax liability, you may also need to make estimated tax payments throughout the year. This ensures that you are keeping up with your tax obligations and avoiding underpayment penalties. Reporting self-employment taxes accurately and timely is crucial to avoid any potential issues with the IRS and to stay in compliance with tax laws.

Tax Withholding

Understanding Tax Withholding

Tax withholding refers to the process of your employer deducting a portion of your income to cover your federal income tax liability. By withholding taxes from your paycheck, your employer helps ensure that you are meeting your tax obligations throughout the year. The amount of tax withheld depends on factors such as your income, filing status, and the W-4 form you provide to your employer.

Form W-4

The Form W-4 is a crucial document that determines how much tax will be withheld from your paycheck. On this form, you provide your employer with information about your filing status, number of allowances, and any additional withholding instructions. The number of allowances you claim on your W-4 affects the amount of tax withheld, with more allowances resulting in less tax being withheld. It is important to review and update your W-4 whenever your personal or financial situation changes to ensure accurate withholding.

Adjusting Withholding

If you find that too much or too little tax is being withheld from your paycheck, you can adjust your withholding by submitting a new Form W-4 to your employer. If you want to increase your withholding, you can indicate a lower number of allowances, or you can request additional withholding by specifying a specific dollar amount to be withheld from each paycheck. Similarly, if you want to decrease your withholding, you can indicate a higher number of allowances or request to withhold no taxes at all. Adjusting your withholding is a way to ensure that you are not overpaying or underpaying your tax throughout the year.

Tax Audits

What is a Tax Audit?

A tax audit is an examination of your tax return or financial records to verify the accuracy and completeness of your reported income, deductions, and credits. The IRS conducts tax audits to ensure that taxpayers are complying with tax laws and reporting their income and expenses correctly. While tax audits may seem intimidating, they are not necessarily an indication of wrongdoing.

Causes of Tax Audits

Tax audits can be triggered by various factors. Some common red flags that may increase your chances of being audited include having a high income, reporting significant changes in income or deductions, claiming excessive business expenses, or engaging in certain transactions that are commonly associated with tax evasion. However, it is important to remember that being audited does not necessarily mean that you have made a mistake or committed an offense.

Preparing for a Tax Audit

If you are selected for a tax audit, it is essential to be prepared and organized. Start by reviewing your tax return and gathering all relevant documentation and records to support your reported income, deductions, and credits. Maintaining accurate and thorough records is crucial throughout the year, as it can make the audit process smoother and potentially help in demonstrating the accuracy of your tax return. It may also be beneficial to consult a tax professional who can guide you through the audit process and represent you before the IRS if necessary.

Taxes are a complex subject, but with the information provided in this comprehensive guide, you are now armed with the knowledge to tackle your tax obligations confidently. Remember to consult with a tax professional if you have any specific questions or need personalized advice. By understanding taxes and implementing effective tax planning strategies, you can ensure compliance with the law while minimizing your tax liability. Happy filing!